What We Finance

Insurance

Calculators

What We Finance

Insurance

Calculators

Service & Availability

Affordable Loan Protection to Give you Peace of Mind.

Protect yourself from missing a payment and damaging your credit history. We understand that taking out a new loan can be a big commitment for some people and if something was to happen to you it could put you into financial hardship.

We offer loan protection to cover some or all of your repayments in case something unthinkable was to happen, such as becoming injured or unemployed. If you suffer a trauma such as cancer, heart attack, stoke or coronary artery bypass or pass away your loan will be paid out to the limit in your policy, which is generally the remaining balance.

Broker of The Year

2021 & 2022

5 Star Rating

From 364+ Customers

Which Loan Protection Insurance is right for me?

There are 3 different levels of cover provided by our panel of insurance providers. We have an obligation to our customers to ensure they have adequate insurance cover in place or have at least explored all options available to them to ensure they make an informed decision. One of our expert Brokers can tailor the right solution to suit your personal circumstances ensuring the cover is fit for purpose.

Death and Trauma Cover

Covers you if you pass away, or have a stroke, heart attack, cancer, or coronary artery bypass then it pays out a lump sum.

Disability Cover

If you are unable to work due to injury or sickness then your repayments are made until you return to work.

Death, Trauma and Disability Cover

Both above covers combined.

Disability and Involuntary Unemployment Cover

If you are unable to work due to injury, sickness or are made involuntarily unemployed then your repayments are made until you return to work.

Death, Trauma, Disability and Unemployment Cover

All above covers

Rostron Finance Specialists About the Different Covers.

Loan Protection can be included in your finance package and will generally only adjust your payments a few dollars a week. Speak to one of our Rostron Finance specialists about the different covers, exclusions and maximum claim limits before making a decision if this is right for you. We can supply you with a Product Disclosure Statement and discuss with you about including Loan Protection in your finance package today.

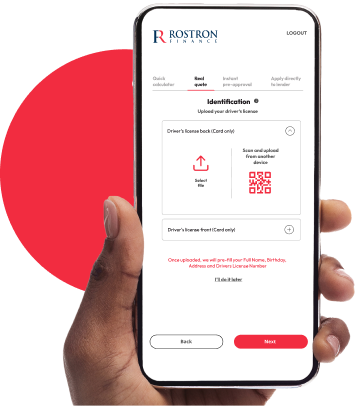

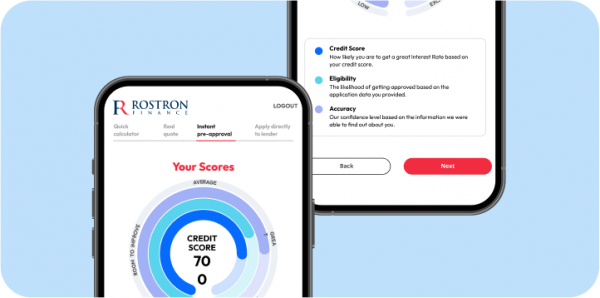

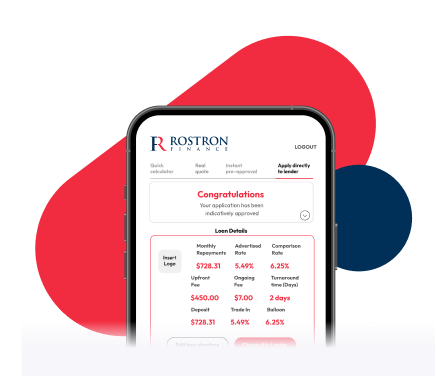

Quick Application in

4 Easy Steps.

Instant Finance Pre-Approval with no impact on your credit score.

Quick Calculator

Instantly calculate your loan options with our smart online calculator

Real Quote

Instant Finance Pre-Approval with no impact on your credit score.

Instant Preapproval

Our powerful lender matching engine will match you with suitable lenders.

Apply to Lender

The fastest ever finance experience! Rostron’s Quick Apply supports direct-to-lender submissions

It’s kinda hard not to love us

“Rostron helped throughout the whole process of financing my car and also helped with insurance.”

Hannah Clare

“I had the confidence I was getting the best deal. Rostron provided a really simple & smooth process”

Ryan Lee, Kerdic Homes Pty Ltd

Secure Your Future Today

With our comprehensive insurance cover, peace of mind is just a policy away.

Brokers you can depend on to get it right

Brokers you can depend on to get it right