What We Finance

Insurance

Calculators

What We Finance

Insurance

Calculators

Service & Availability

Affordable loan protection to give you peace of mind.

Shortfall Gap Cover (Also known as Motor Equity) covers you in the event that your vehicle is written off, it pays the difference between the total loss payout you receive from your comprehensive insurer and the remaining balance of your loan.

Once your insurer pays the financier the amount of the total loss, the financier will request the loan to be finalised (as there is no longer security behind the loan). The Gap cover pays the remaining difference between the amount the comprehensive insurer pays, and the remaining balance (inclusive of fees, interest, etc.) to the amount chosen in your policy, usually finalising your loan and saving you thousands of dollars. See diagram for more info.

Broker of The Year

2021 & 2022

5 Star Rating

From 364+ Customers

Learn from Professionals

Work closely with other experienced brokers and the management team, who will give you the training and resources necessary to grow and develop within the industry and Rostron Finance group. Our goal is to look for enthusiastic and motivated people such as you, with a drive to join a team of other experienced and likeminded individuals.

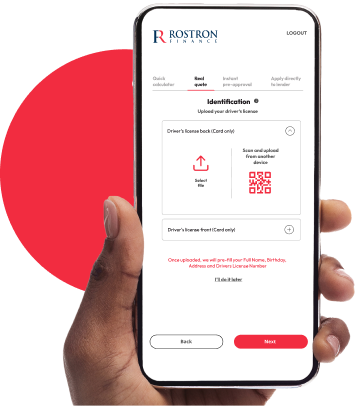

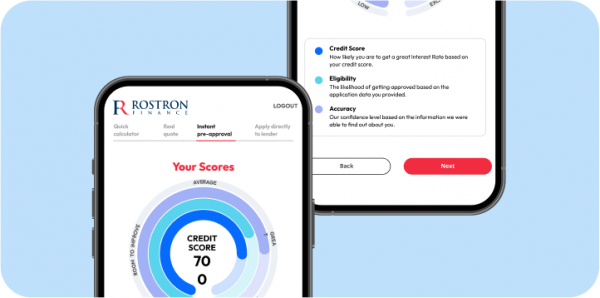

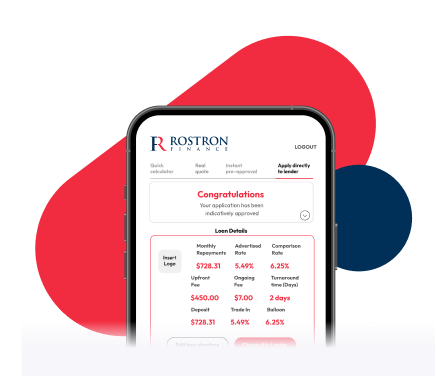

Quick Application in

4 Easy Steps.

Instant Finance Pre-Approval with no impact on your credit score.

Quick Calculator

Instantly calculate your loan options with our smart online calculator

Real Quote

Instant Finance Pre-Approval with no impact on your credit score.

Instant Preapproval

Our powerful lender matching engine will match you with suitable lenders.

Apply to Lender

The fastest ever finance experience! Rostron’s Quick Apply supports direct-to-lender submissions

It’s kinda hard not to love us

“Rostron helped throughout the whole process of financing my car and also helped with insurance.”

Hannah Clare

“I had the confidence I was getting the best deal. Rostron provided a really simple & smooth process”

Ryan Lee, Kerdic Homes Pty Ltd

Secure Your Future Today

With our comprehensive insurance cover, peace of mind is just a policy away.

Brokers you can depend on to get it right

Brokers you can depend on to get it right